Refund Disbursements

Ways Your Client Can Receive Tax Refunds

Give Your Client’s the Power to Choose How to Collect Their Refund

We have three convenient, no-hassle options for how your clients want to receive their refund1 or advance loan2 if they need emergency cash.

FasterMoney® Visa® Prepaid Card3

The Prepaid Card That Saves You Time

The FasterMoney Visa Prepaid Card is a great option for clients who don’t have a traditional bank account in which to receive their tax refunds. The taxpayer doesn’t have to come back to the office to pick up a check. The prepaid card saves you time and the cost of printing a check while giving clients a secure and easy way to access their refund.

- Get money quick (compared to direct deposit or check)

- No credit checks

- No check cashing fees

- Secure

- Mobile App

- Year-round use

Check Cashing

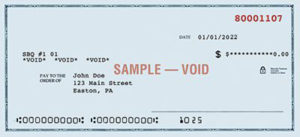

Disburse your client’s refund by printing a secure check* from your office that they can pick up at their convenience and then cash at one of 10,000 locations nationwide. A toll-free verification number and website address are printed on all checks, enabling check verification 24-hours a day.

Tips and Tricks for Successful Printing

*Amount may vary. Not representative of actual tax refund/direct deposit.

- If you have not already, make sure to destroy all remaining check stock from previous years and only use the new check stock we are sending you

- Test which way paper goes into your printer by writing an arrow on it and printing a document to avoid putting the check stock in the wrong way. Make sure to load your check stock into the printer before printing a check

- If you do not see a check authorization, try logging out and logging back in

- Make sure check sequence is correct and numbers match before printing

- When you start a new packet of checks, update your check range in the system

- Best practice is to print checks the night before funding. You will be sent a check print notification around 6pm the night before funding. Otherwise, wait an hour after printing before giving it to your client

- Inform your client that checks are only valid for 90 days. If it has been more than 90 days, give EPS a call at 888-782-0850

Check Verification & Misprints

- Do not verify the check. Checks can only be verified once and should be done by the institution handling the check

- If a check has been verified and not cashed, a verification reset will be necessary

- Printing out a new check will not resolve the issue. Fill out the Check Verification Reset form and send along with a copy of the check. Do not void the check as this check will be returned to the taxpayer. If you have printed multiple checks, please void the older checks and send along with the form

- If a check is misprinted, do not destroy it. Write void across it and keep it for your records in case we need it to send a new check authorization or a check verification reset

Check Cashing Locations

Walmart® provides check-cashing services for checks issued to your clients. Walmart charges a $4 fee to cash checks of $1,000 or less, and $8 to cash checks over $1,000. Availability and check cashing limits vary by state and are subject to applicable law. Check with your local Walmart Money Center for more details.

![]()

Our checks may also be cashed at 7-Eleven stores equipped with the Vcom check-cashing kiosk. This kiosk is a fully automated check-cashing machine with touch-screen technology in English and Spanish. Vcom is available at over 2,100 locations nationwide and is available 24 hours a day. Visit www.7-eleven.com to find the 7-Eleven Vcom location closest to you.

Direct Deposit

Tax fund proceeds are deposited directly to a client’s bank account giving them immediate and convenient access to their funds.

*Amount may vary. Not representative of actual tax refund/direct deposit.

1. The Refund Transfer is an optional tax refund-related product offered by Pathward®, N.A., Member FDIC. The Refund Transfer is not a loan. E-filing of tax return is required to be eligible for the product. Subject to approval. Fees apply. See terms and conditions for details.

2. The Refund Advance is an optional tax-refund related loan provided by Pathward, N.A., Member FDIC (it is not the actual tax refund) at participating locations. Program availability and loan amounts may vary based on state and software provider. The amount of the loan and applicable interest will be deducted from tax refunds and reduce the amount that is paid directly to the taxpayer. Fees for other optional products or product features may apply. Tax returns may be filed electronically without applying for this loan. Loans offered in amounts of $250 (where available), $500, $1,000, 25%, 50%, or 75% of your expected tax refund up to $7,000, with interest-based applicants receiving an average of $2,003.41; $7,000 available only to well-qualified applicants with a minimum expected tax refund of $9,569. Underwriting standards subject to change. When calculating the amount of your loan, the amount of your “expected” tax refund may be affected by any refundable tax credits and fees. Loans in the amounts of $250, $500, and $1,000 have an Annual Percentage Rate (APR) of 0.00%. Loans in the amounts of 25%, 50% or 75% of your expected tax refund have an APR of 36.0% with a minimum loan of $1,250. For example, $2,500 loan representing 50% of expected refund borrowed over 31-day term, total amount payable in a single payment is $2,576.44 including interest. Availability is subject to satisfaction of identity verification, eligibility criteria, and underwriting standards.

3. The FasterMoney Visa® Prepaid Card is issued by Pathward®, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc.